On April 3, Global Energy Monitor (GEM), along with partner organizations released “Boom and Bust Coal 2025”, an annual report which analyzes key trends in coal power capacity worldwide. Now in its 10th year, it emphasizes that Japan and South Korea are jeopardizing the phaseout of coal-fired power by clinging to uncertain technologies touted by both governments as “decarbonization technologies”.

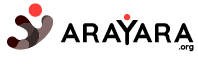

As the world moves toward phasing out coal-fired power plants, Japan and South Korea each have one coal plant under development: GENESIS Matsushima (0.5 GW) in Japan, and Samcheok power station (1 GW) in Korea. Continuing to use coal-fired power by co-firing ammonia and hydrogen would be out of step with developed countries that are phasing out coal-fired power over the next 10 years, but both countries are not only accelerating the promotion of ammonia and hydrogen as fuel, they are planning to export these technologies to other Asian countries.

GENESIS Matsushima Project: J-Power plans to add a gasification unit to the existing Matsushima Thermal Power Station Unit 2 (Nagasaki prefecture) to generate electricity using gas containing hydrogen. It is currently under the environmental impact assessment process.

Samcheok Power Station: Project to build two units of supercritical coal-fired power in Samcheok, Gangwon, South Korea. Unit 1 started commercial operation in October 2023, and Unit 2 is under construction with plans to start commercial operation 2025.

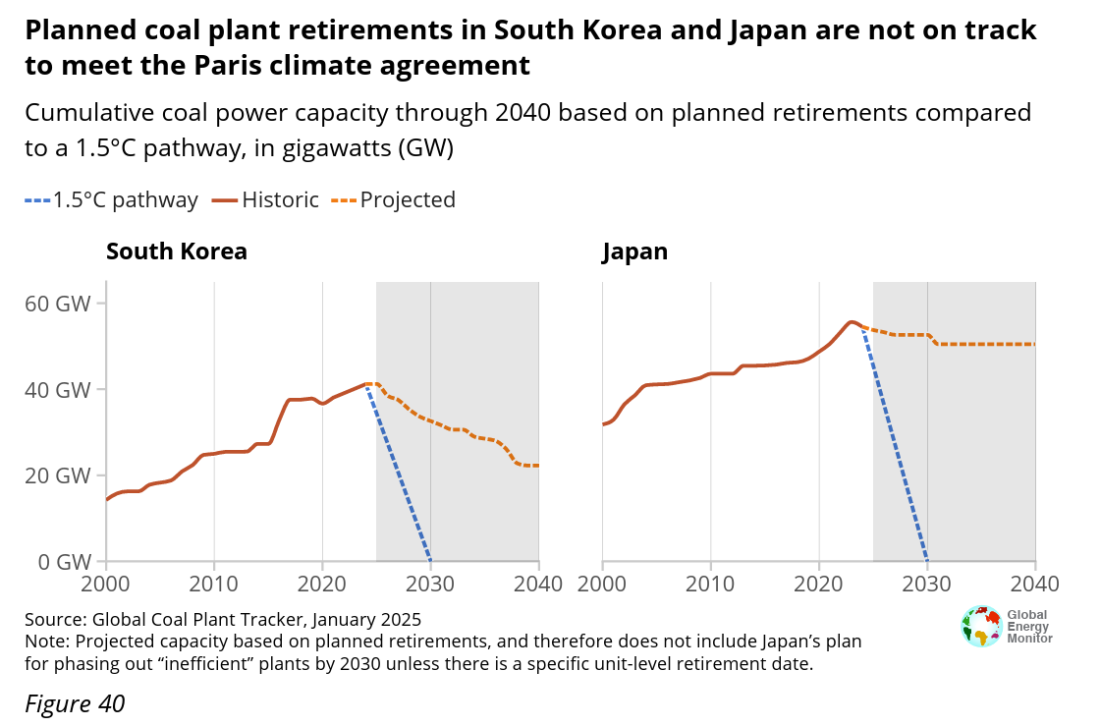

There are small differences between the plans of these two countries. South Korea plans to introduce 20% ammonia co-firing across the country, maintaining ammonia as a secondary fuel. On the other hand, Japan plans to introduce ammonia and increase its co-firing rate from 20% to ultimately 100%, and replace coal-fired power plants with ammonia mono-firing. In any case, however, their CO2 emission reduction plans still rely on unestablished co-firing technology, and the report points out that such strategies are not consistent with the goals of the Paris Agreement.

Some other key global developments of 2024 pointed out in the report:

- At 44 gigawatts (GW), 2024 marked the lowest level for newly operating coal power in 20 years, since 2004. The capacity commissioned was nearly 30 GW below the annual average for 2004 to 2024 (72 GW). The 44 GW of new coal power capacity added was higher than the 25.2 GW retired, leading to a net increase in the global coal fleet of 18.8 GW. Outside of China, coal power capacity decreased by 9.2 GW, as retirements (22.8 GW) exceeded additions (13.5 GW).

- Coal power capacity under development outside of China and India decreased for the tenth year in a row, falling over 80% from 445 GW in 2015 to 80 GW in 2024. Ten countries now account for 96% of coal power capacity development. 2024 was also a record year of new coal plant proposals in India (38 GW), with India and China alone accounting for 92% of all newly proposed coal power capacity across the globe in 2024 (107 of 116 GW).

- New coal proposals have dwindled in Southeast Asia due to coal phaseout pledges in Indonesia and Malaysia, a moratorium on coal plant permitting in the Philippines, and the development of just transition planning in Vietnam.

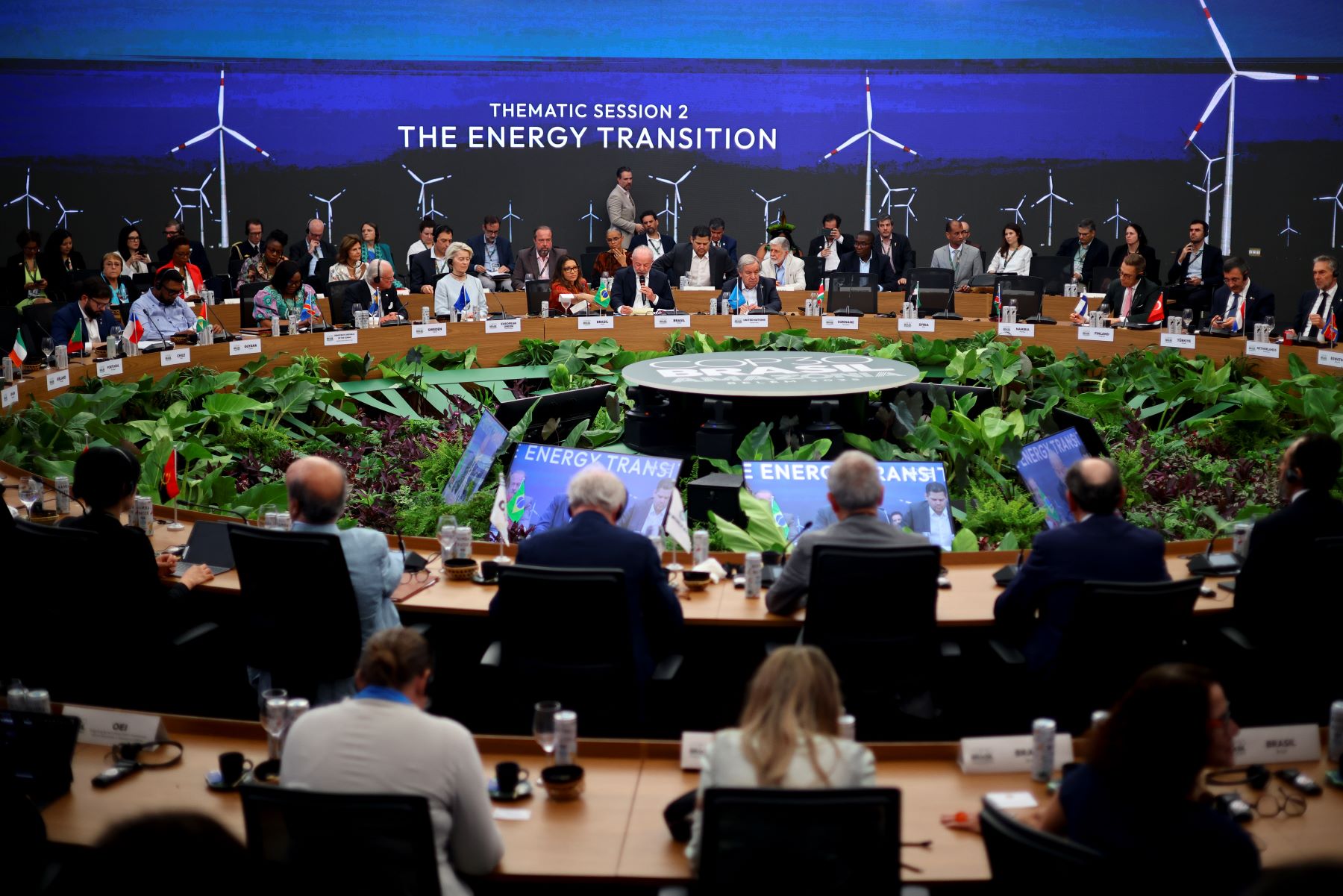

- Retirements in the EU27 increased fourfold over 2023, from 2.7 GW to 11 GW, led by Germany (6.7 GW). Elsewhere in Europe, the UK shut down its last coal plant and became the sixth country to phase out coal power since the 2015 Paris climate agreement.

- In the 38 countries comprising the Organization for Economic Cooperation and Development (OECD), coal plant proposals are down from 142 in 2015 to five today. Still, annual coal capacity retirements in OECD countries need to more than triple in order to meet the international Paris climate agreement (from 19 to 70 GW).

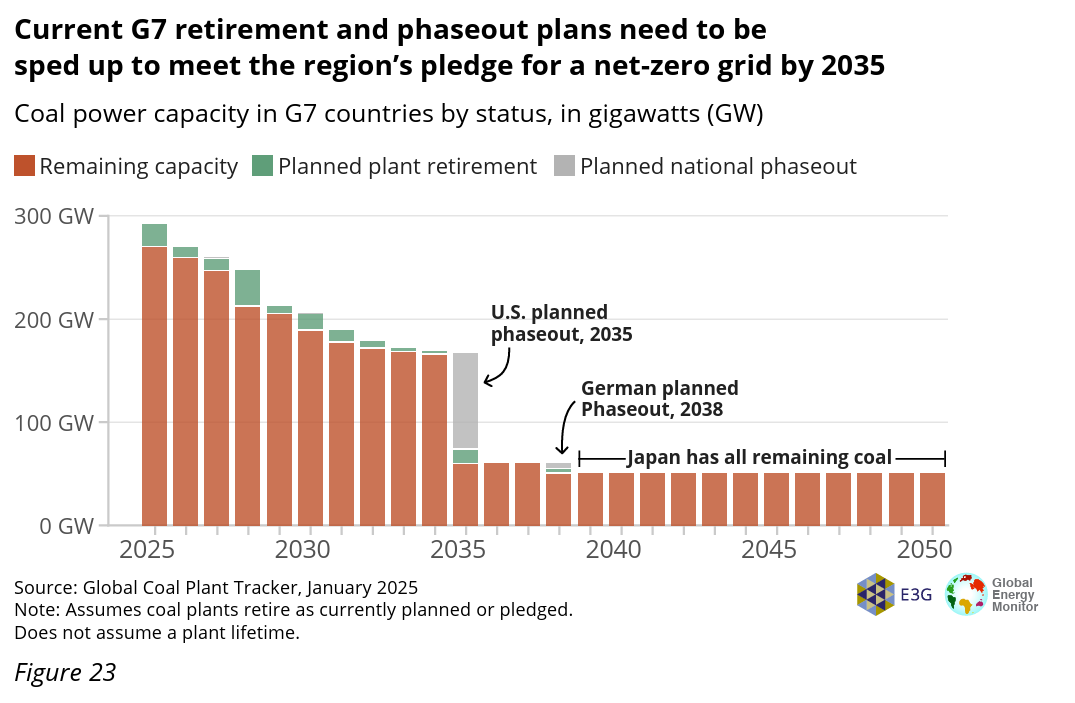

This figure shows that Japan is the only G7 country that has not set a date to phase-out coal-fired power plants.

Press Release

New coal drops to lowest level in two decades (PDF)

Report Download

Boom and Bust Coal 2025 Tracking The Global Coal Plant Pipeline(Link)

Global Coal Plant Tracker(Link)

Written/Published by: Global Energy Monitor, CREA, E3G, Reclaim Finance, Sierra Club, SFOC, Kiko Network, CAN Europe, Waterkeepers Bangladesh, Dhoritri Rokhhay Amra (DHORA), Trend Asia, PRIED, Chile Sustentable, POLEN, Bankwatch, INSAPROMA, and Africa Just Transition Network (AJTN) and ARAYARA

Published: April 3, 2025

Fonte: Japan Beyond Coal